What Is Supplemental Security Income?

Supplemental Security Income (SSI) is a federal program that helps people who are disabled, blind, or elderly and have limited income and resources. The program is designed to provide financial support to those who need it most, helping them maintain a basic standard of living when working is difficult or impossible.

A Short History of SSI

Established under Title XVI of the Social Security Act, the Supplemental Security Income program was created in 1972. Unlike Social Security retirement or disability benefits, which are earned through a worker’s payroll taxes, SSI is a need-based program.

Administered by the Social Security Administration (SSA) but funded by general tax revenues—not Social Security trust funds—SSI provides monthly cash payments to individuals and couples who meet very stringent criteria. More than 7 million people rely on SSI benefits, including over 1 million children with disabilities.

SSI is more than simple financial aid. For many recipients, these monthly payments represent the only reliable source of income, helping them pay for food, rent, utilities, and essential medications. Without SSI, countless Americans would face homelessness and malnutrition, or forgo important medical care and prescriptions.

Through this support, SSI helps stabilize communities by reducing the strain on local charities and healthcare systems. By keeping vulnerable individuals housed and supported, the SSI program promotes public health, reduces emergency service usage, and sustains a baseline of economic participation even among those who cannot participate in the workforce.

Who Is Eligible for SSI?

Supplemental Security Income benefits are for people who are:

- Disabled,

- Blind, as defined by law, or

- Age 65 or older.

Beyond these thresholds, the applicant must have limited income and limited resources. As of 2025, claimants generally must have countable resources of $2,000 or less, or $3,000 for couples. Certain assets—such as your home, a single vehicle, and some personal effects—are excluded.

Many people are surprised to learn just how low the resource limits are for SSI eligibility. The current caps have not changed in decades; they don't adjust with inflation. As a result, even modest savings can disqualify someone from receiving SSI benefits. Congress has considered proposals to increase these thresholds, and current rules allow some individuals to maintain greater assets in specific types of trust accounts, such as special needs trusts.

It is important to distinguish income (wages, Social Security benefits, etc.) from assets (savings, investments, property), which impact eligibility and benefits in different ways. Both income and assets, however, can render someone ineligible for SSI benefits.

How Is Disability Determined for Adults?

To be found "disabled" for SSI purposes, an adult must show that they have a medically determinable physical or mental impairment—or a combination of impairments—that prevents them from performing substantial gainful activity (SGA). The condition must be expected to last at least 12 consecutive months or result in death. In layman’s terms, to get SSI benefits, you must be unable to work full-time for at least a year.

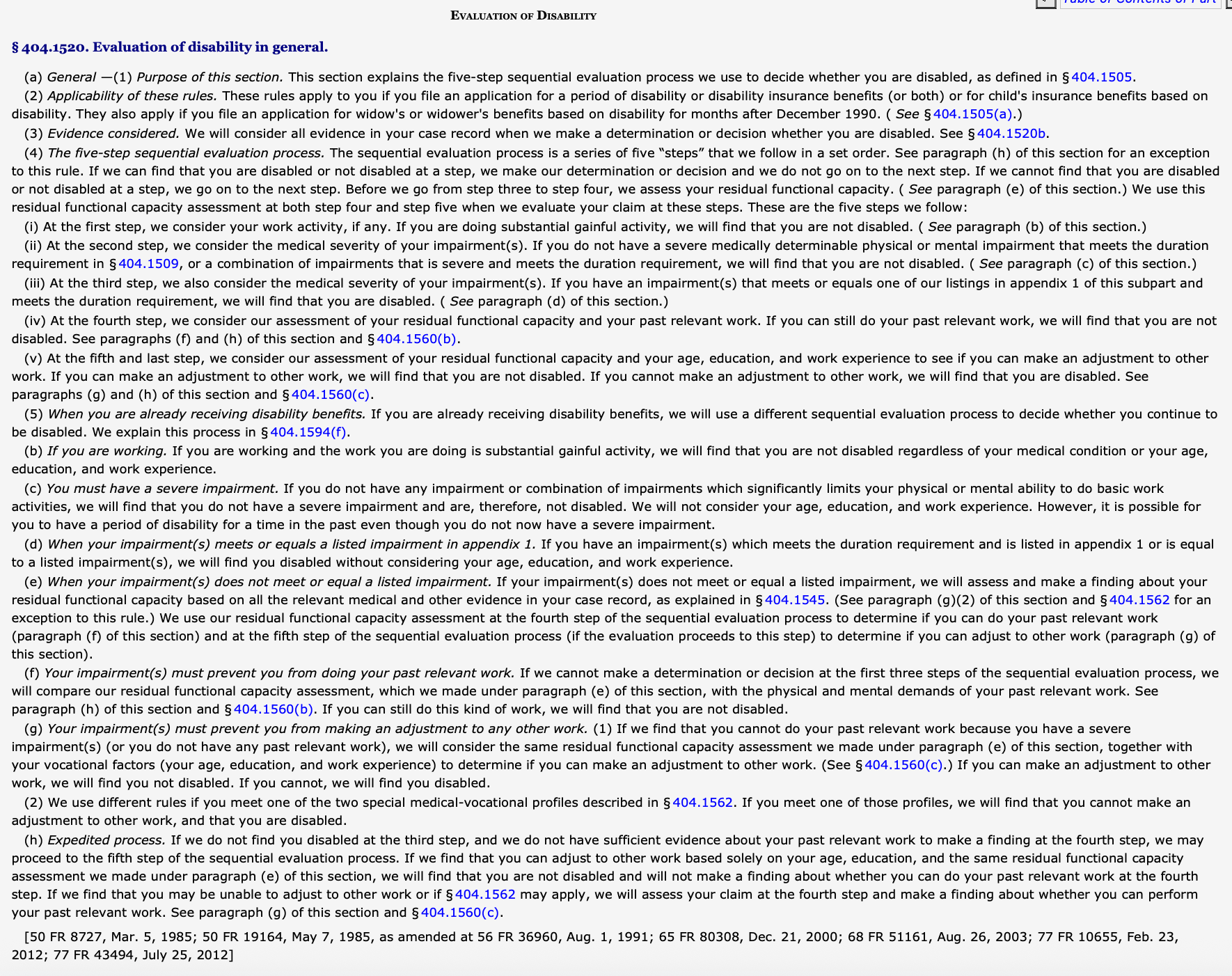

The SSA uses a five-step process to make this determination. This process asks whether the claimant is currently working above the SGA threshold, whether they have a severe medical condition, whether any of their conditions meet or equal the high standards detailed in the SSA’s Blue Book, whether the person can return to their past relevant work, and whether the claimant can perform any other work considering their age, education, and work experience. Each step ensures that benefits only go to those who can't work.

Many SSI claims ultimately reach the hearing level, where they are decided by an Administrative Law Judge (ALJ). At this stage, the claimant is required to submit evidence and is often asked to testify. In most hearings, a vocational expert hired by the Social Security Administration will testify about the types of jobs available to people with similar limitations. Claimants or their representatives can cross-examine this witness to challenge whether such jobs are realistic, or even exist.

How Is Disability Determined for Children?

For children under the age of 18, the Social Security Administration uses a different standard to determine disability. Instead of evaluating whether a child can work—most kids, after all, couldn't hold down a job, and we don't expect them to do so—the SSA examines whether the child has an impairment that results in "marked" or "extreme" limitations, or a combination of conditions that results in functionally equivalent limitations.

SSA assesses a child's abilities by comparing the child to their same-aged peers without impairments. This includes evaluating the child's learning, mobility, communication, and social interactions. If the child’s condition meets or medically equals one of the listings, or functionally equals them in severity, the child has satisfied the non-medical eligibility requirements for SSI benefits.

How Much Does SSI Pay?

The SSI payment amount is not fixed but varies based on living arrangements and countable income. As of 2025, the federal benefit rate (FBR) is $967 per month for individuals and $1,450 for couples. Some states supplement these federal amounts with additional payments.

Moreover, in some states, SSI recipients may become automatically eligible for Medicaid and other assistance programs. SSI thereby becomes the foundation for receiving several types of social aid.

But SSI monthly payments may reduce due to other considerations, most notably in-kind support and income.

For individuals who live in someone else's household and receives free shelter from that person, the Social Security Administration may apply what's called the Presumed Maximum Value (PMV) rule. Under this rule, the SSI benefit is typically reduced by one-third of the Federal Benefit Rate (FBR) plus a small amount, which in 2025 totals a reduction of approximately $334 for individuals. This means that instead of receiving the full $967, an individual affected by the PMV rule would receive about $633 per month. As of September 30, 2024, the Social Security Administration no longer considers whether someone receives free food when reducing SSI payments due to in-kind support.

In addition, income reduces the SSI benefit amount on a dollar-for-dollar basis after certain exclusions are applied. The first $20 of most income received in a month is not counted, nor is the first $65 of earnings. After that, SSI benefits are reduced by half of the remaining earned income.

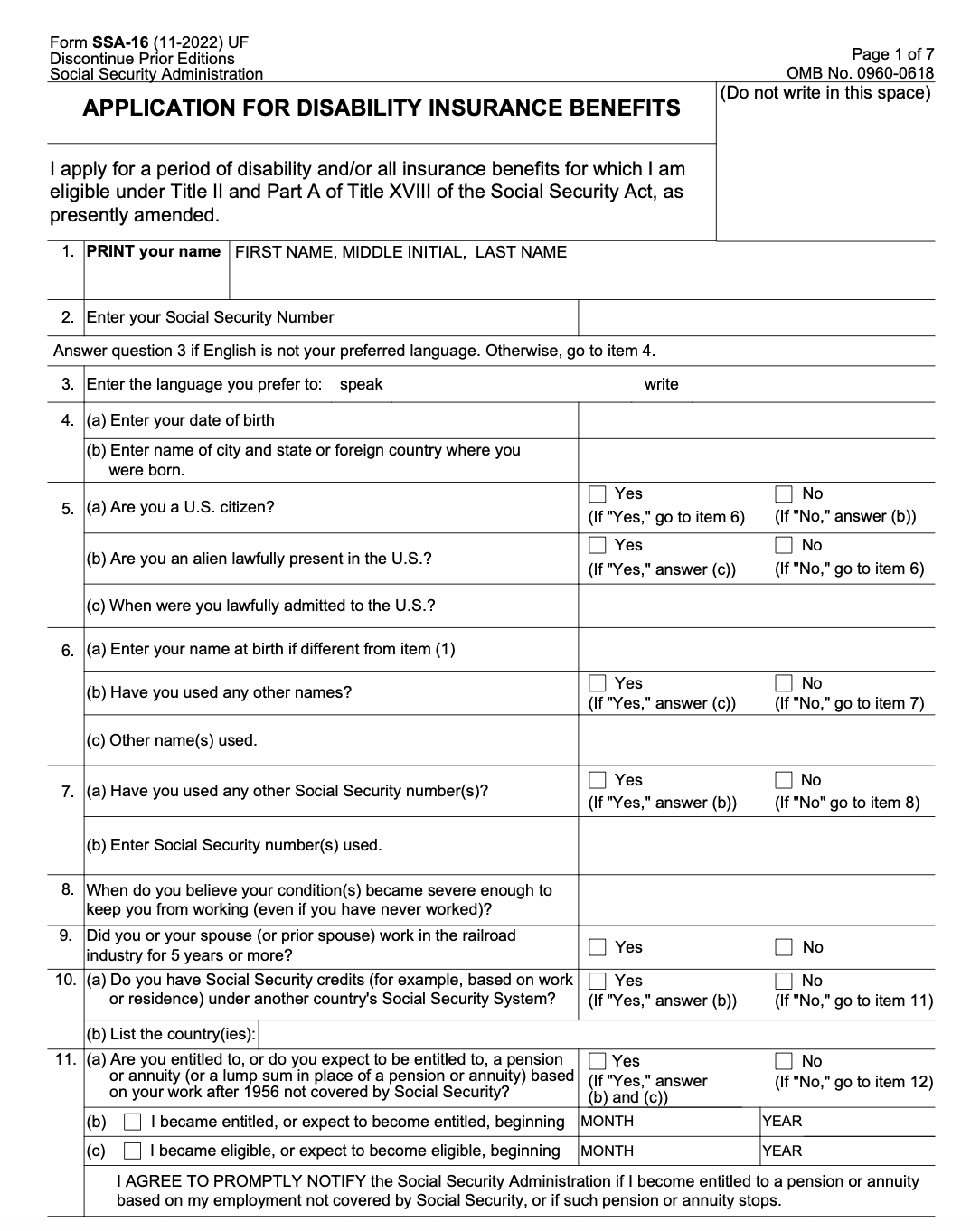

How to Apply for SSI Benefits

You can apply for SSI through:

- A paper application (form SSA-8000-BK or SSA-8001-BK)

- A phone call with the Social Security Administration

- Less commonly, visiting a local SSA office

It can be daunting to apply for SSI. The application process typically requires gathering a significant amount of documentation, including detailed medical records, financial statements, and proof of living arrangements. Applicants must also navigate rules and eligibility standards, as well as procedural requirements and deadlines, that can be difficult to interpret. Nonetheless, it's important put in the effort to get these things right: Mistakes or incomplete information can lead to delays or denials.

Final Thoughts on SSI

Supplemental Security Income (SSI) provides basic financial support to disabled and elderly individuals with limited means. For many recipients, including children, it's the difference between stability and hardship, possibly even homelessness. Donoff & Lutz, LLC represents claimants navigating the application process, including people applying for the first time and those appealing denials.

Disclaimer: The information provided in this blog is for general informational purposes only and does not constitute legal advice. Reading this blog does not create an attorney-client relationship. For advice specific to your situation, please contact Donoff & Lutz, LLC directly to speak with an attorney.