Social Security Disability COLA Explained | SSDI & SSI Benefit Increases

Social Security disability COLAs are based on inflation, not discretion. Learn how SSDI and SSI cost-of-living adjustments are calculated and when increases apply.

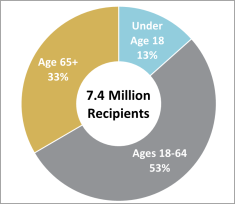

Each year, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) recipients rely on cost-of-living adjustments (COLAs) to offset inflation. These adjustments significantly affect household budgets, but most people do not understand how the COLA is calculated.

Contrary to popular belief, COLAs are not discretionary increases or political decisions. They are determined by a legally required formula and applied automatically by the Social Security Administration (SSA).

What Is a Social Security COLA?

A cost-of-living adjustment is an automatic increase intended to preserve the purchasing power of Social Security benefits when consumer prices rise. COLAs apply uniformly across Social Security programs, including:

- SSDI

- SSI

- Retirement benefits

- Survivors benefits

There is no separate COLA calculation for disability benefits. SSDI beneficiaries receive the same percentage increase as retirees. See 42 U.S.C. § 415(i).

The Inflation Index Used: CPI-W

The Social Security COLAs are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), published monthly by the

U.S. Bureau of Labor Statistics (BLS).

The CPI-W measures changes in prices for a market basket that includes:

- Food and beverages

- Housing

- Transportation

- Energy (gasoline and utilities)

- Medical care

- Apparel and other consumer goods

Federal law requires the SSA to use CPI-W—not an index tailored to retirees or people with disabilities. See 42 U.S.C. § 415(i)(1)(B).

How the COLA Is Calculated

COLAs are determined using a three-month comparison, not annual inflation totals:

- The SSA calculates the average CPI-W for July, August, and September of the current year.

- That average is compared to the highest prior average for those same months in any previous year.

- If the current average exceeds the prior peak, the percentage increase becomes the COLA.

- If not, no COLA is paid.

Benefits are never reduced due to inflation. They either increase or remain unchanged. The SSA explains this process in detail

here.

Why COLAs Often Feel Inadequate

Many disability beneficiaries feel that COLAs do not fully offset rising expenses, perhaps because people receiving disability benefits may see their costs rising more quickly than other people:

- Medicare premium and medical costs—disproportionately borne by people with disabilities—often rise faster than overall inflation

- The CPI-W reflects spending patterns of working households, not disabled or retired populations, who may spend on different products

- COLAs are based on national averages and do not account for regional cost differences

At most, COLAs should be viewed as inflation protection, not income growth.

When COLAs Take Effect

COLAs are typically announced in October, but take effect later:

- SSDI and retirement benefits reflect the COLA in January payments

- SSI benefits reflect the COLA in December payments, usually issued in late November

This timing difference often causes confusion but does not change the adjustment amount.

Can Congress Change the COLA Formula?

Yes. Congress may amend the COLA formula through legislation. Proposals have included:

- Switching to CPI-E, which tracks older Americans’ spending

- Adopting “chained CPI,” which generally produces smaller increases

Absent legislative change, the SSA must continue using CPI-W.

Know How Your Benefits Will Change

Social Security disability COLAs are automatic, formula-driven adjustments mandated by federal law. While they play a critical role in protecting benefits against inflation, they are limited by the structure of the CPI-W and may not fully account for the unique expenses faced by people with disabilities.

Understanding how COLAs are calculated—and how they affect SSI and SSDI differently—allows beneficiaries to better plan and avoid surprises.

Disclaimer: The information provided in this blog is for general informational purposes only and does not constitute legal advice. Reading this blog does not create an attorney-client relationship. For advice specific to your situation, please contact Donoff & Lutz, LLC directly to speak with an attorney.