What Is a Date Last Insured (DLI)?

What Is a Date Last Insured?

If you’re applying for Social Security Disability Insurance (SSDI) or helping someone who is, you may come across a confusing term: date last insured, often shortened to “DLI.”

This guide explains the meaning of the date last insured, how it’s calculated, and why it’s so important in Social Security disability cases.

What Is a DLI (Date Last Insured)?

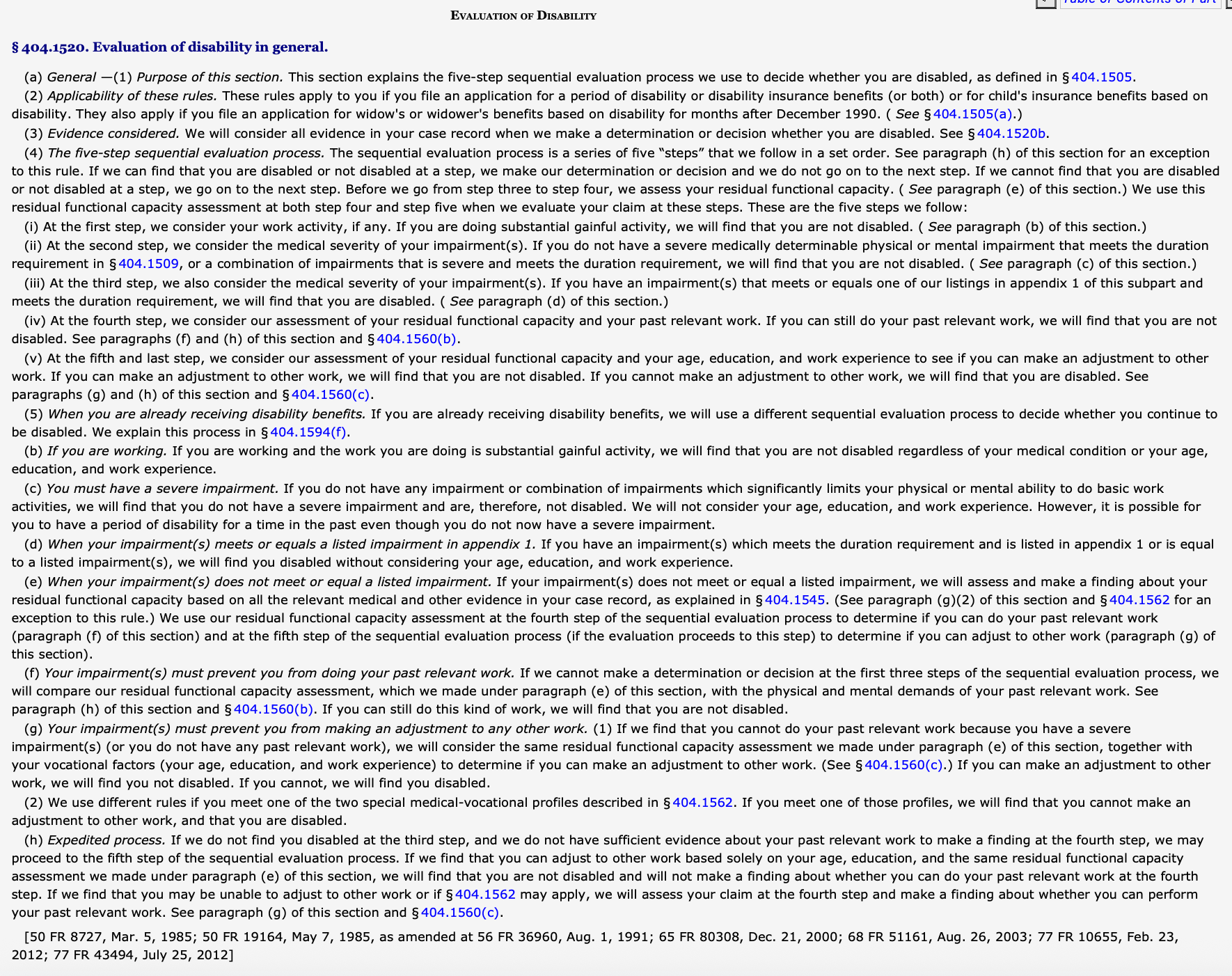

The date last insured (DLI), based on your work history, is the last day you are eligible to start receiving SSDI benefits. To qualify for SSDI, you must have both a medical disability and disability insured status when your disability began. The DLI is the final day on which you have disability insured status.

Your date last insured marks the cutoff point. If the Social Security Administration determines that your disability started after your DLI, your SSDI claim will be denied—even if you are disabled today.

I often like to compare SSDI to a private insurance plan. If you pay for private insurance, you will receive insurance coverage—but not forever. Eventually, you must pay additional premiums to continue that coverage. The “date last insured” is simply the last day that SSDI insures you against becoming disabled.

How Do You Become “Insured” for SSDI?

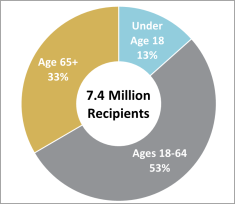

SSDI is not a needs-based program. It works more like insurance, which you pay into through payroll taxes.

You earn work credits (sometimes called quarters of coverage) when you work and pay Social Security taxes. In most cases, you need 20 work credits in the 10 years before becoming disabled. You also need to have earned enough total credits over your work life, with the required number depending on your age.

Once you stop working or your earnings drop significantly, the clock starts ticking toward your date last insured.

Please note that you become insured by paying Federal Insurance Contributions Act (FICA) payroll taxes. If you worked for an employer where you did not pay payroll taxes—like many public schools and some religious institutions—you are not earning SSDI work credits. If you worked “under the table,” then you also aren’t earning work credits.

How Is the Date Last Insured Calculated?

Your DLI is calculated based on your earnings record with Social Security. If you previously had a consistent work history, your date last insured is usually about five years after you stop working at a substantial level.

For example:

- If you consistently worked from 2000 through 2020

- And you stopped working in 2020

- Your date last insured will likely fall sometime in 2025

After that date, your insured status expires unless you return to work and earn additional credits.

It becomes more complicated if you have an inconsistent work record, but the same general rule controls: you need 20 work credits over the previous 10 years. For example, if you had two years of unemployment during that period, then you might only have insured status for 3 years after your work ended.

Why Is the Date Last Insured So Important?

The date last insured is critical because Social Security must find that your disability began on or before your DLI.

This means:

- Medical records must show you were disabled before your insured status expired

- Later medical evidence can help, but it must relate back to the period before your DLI

- SSDI cases sometimes hinge on proving an earlier disability onset date

Many SSDI claims are denied not because the person isn’t disabled—but because they cannot prove disability prior to the date last insured.

Can You Still Apply for SSDI After Your Date Last Insured Has Passed?

Yes—you can apply for SSDI after your DLI has passed.

You can file an SSDI application after your date last insured, and still receive SSDI benefits, as long as you can prove (among other things) that your disability began before your DLI.

However, the longer the gap between your DLI and your application, the harder it can be to gather persuasive medical evidence. Healthcare facilities have only limited periods during which they are required to keep medical records. And, in practice, some medical providers do not keep records as long as they are supposed to keep them.

If you did not receive medical treatment prior to your DLI—or did not receive enough treatment to prove your disability—it can become very difficult to win an SSDI claim. At that point, you cannot simply obtain new treatment to retroactively establish disability during the insured period.

It’s important not to confuse SSDI with Supplemental Security Income (SSI). SSI provides monthly benefits to disabled people with very limited financial resources. SSDI requires insured status and has a date last insured; SSI does not depend on work history and has no DLI. If your SSDI insured status has expired, you may still qualify for SSI if you meet income and asset limits.

How Do You Find Your Date Last Insured?

Although we have seen a lot of errors in my Social Security accounts, you can find your date last insured by logging into your my Social Security account at SSA.gov. You can also review Social Security notices, call your local Social Security office, or ask your disability attorney.

Disclaimer: The information provided in this blog is for general informational purposes only and does not constitute legal advice. Reading this blog does not create an attorney-client relationship. For advice specific to your situation, please contact Donoff & Lutz, LLC directly to speak with an attorney.